missouri no tax due system

Hard to say without knowing your specific situation so take this with a grain of salt. If you have any questions please contact the Missouri Department.

Tandy 1200 Hd Computer At Radio Shack 1986 Radio Shack Tandy Radio

See MO-1040 Instructions for more details.

. A business may obtain a no tax due online if it. My wife and I have never owed in Missouri State taxes in the last 5 years even when we owed a few thousand in Federal taxes due to me not lowering my allowances after my wife graduated from nursing school. How to Obtain a Statement of No Tax Due.

The 4225 percent state sales and use tax is distributed into four funds to finance portions of state. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax.

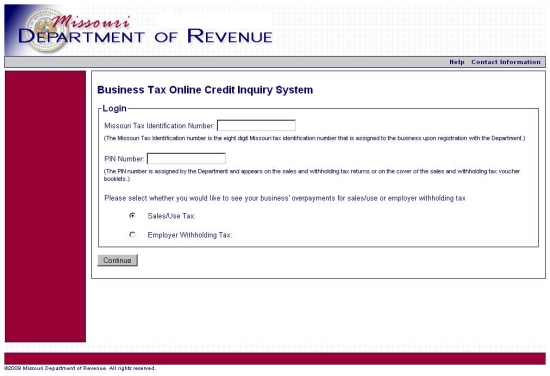

Its been a long time coming. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. Missouri No Tax Due System.

On June 30 2021 Missouri became the last state with a sales tax to require out-of-state sellers and marketplace facilitators to collect and remit sales and use tax. Of Revenue Taxation Division at 816-889-2944 or Harrisonville City Collector Dee Shelton at 816-380-8908. Use tax is imposed on the storage use or consumption of tangible personal property in this state.

If your business does not make retail sales you are not required to present a Statement of No Tax Due to purchase your business license. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due. Ad Find Mo No Tax Due.

The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. Senate Bill 153 establishes economic nexus which bases a sales tax collection obligation solely on a remote sellers economic activity in the state. Search a wide range of information from across the web with topsearchco.

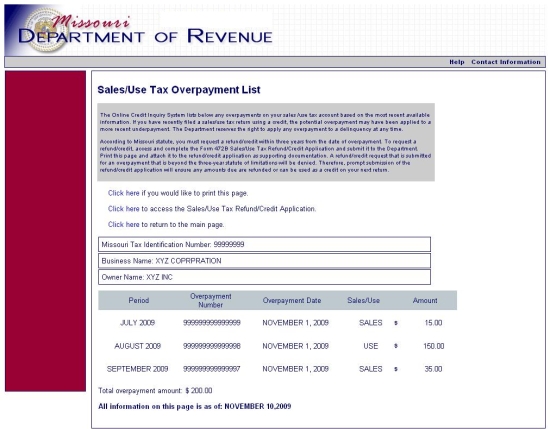

Sales Use Tax Credit Inquiry Instructions

Missouri Governor Vetoes Tax Rebate Plan From Record 49 Billion State Budget Missouri Independent

Sales Use Tax Credit Inquiry Instructions

Individual Income Tax Electronic Filing

Jos And Cos Yung Overtime Nagiging Offertime Meltabucaohipol

Annual Expenses Tracker Free Download

Washington Missourian Washington Mo 1964 05 21 Washington Missourian Anniversary Sale Goodyear

Sales Use Tax Credit Inquiry Instructions

Sales Use Tax Credit Inquiry Instructions

Top Reasons For Irs Tax Audits Irs Taxes Debt Relief Programs Tax Debt

Truck Driver Trip Report Template

Missouri Vehicle Registration Of New Used Vehicles Faq

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market That Had B Sales Tax Tax Filing Taxes

Business Opportunities Searching For Good Home Business Ideas Check These Out Online Business Tips Tricks

Annual Report Template Word Professional Resume Examples For Corporate Jobs Beautiful Gallery Cfo Resume Best Templates Ideas

Tax Collections Beat Expectations Tax Lawyer Tax Day Income Tax