nebraska sales tax rate changes

Tax reports name changes annual filings etc. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

States With Highest And Lowest Sales Tax Rates

2022 California Sales Tax Changes Over the past year there have been 58 local sales tax rate changes in California.

. Nebraska saw the largest decrease in sales taxes this year improving its combined state and local sales tax ranking by two spots. Images of filed business documents are available through the online Corporate Image searches. Lincoln drove this change by decreasing its sales tax from 15 percent to 10 percent offsetting increases in a few smaller Nebraska municipalities.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. Corporate Searches and Document Images Go. The state sales tax rate in Nebraska is 5500.

At a glance calculating sales tax seems simple. The Nebraska state sales and use tax rate is 55 055. Take the price of a taxable product or service and multiply it by the sales tax rate.

Depending on local sales tax jurisdictions the total tax rate can be as high as 1025. Select the Nebraska city from the list of popular cities below to see its current sales tax rate. These documents are instant-access and can be viewed in the web.

The California state sales tax rate is 725. While Wyomings ranking did not change the state saw the years second-largest combined. Nebraska has recent rate changes Thu Jul 01 2021.

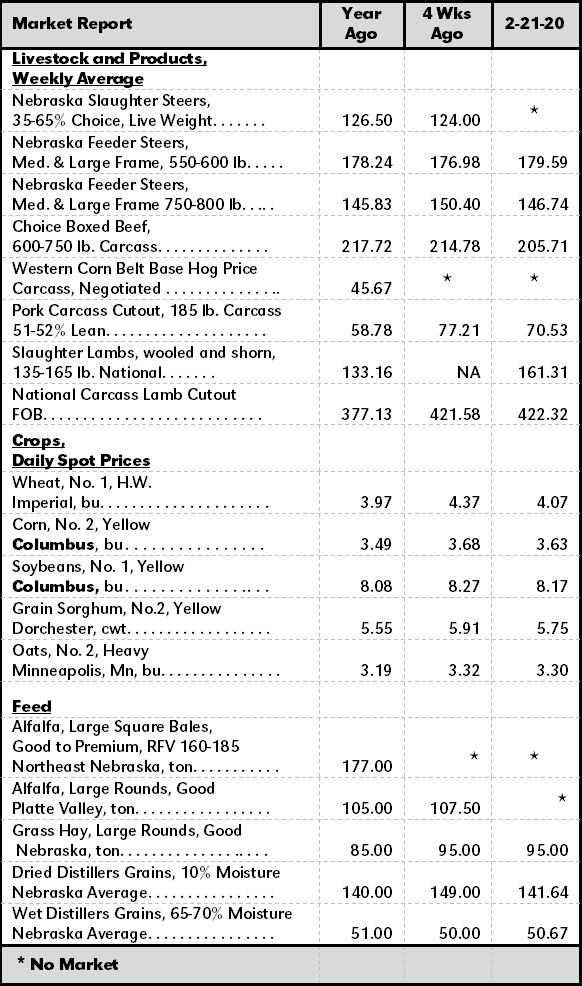

This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials. Food and prescription drugs are exempt from sales tax. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for.

Contact Nebraskagov 402-471-7810 or 1-800-747-8177. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. With local taxes the total sales tax rate is between 5500 and 8000.

The real trick is figuring out what needs to be taxed and then calculating the correct tax rate which depending on how your business operates could. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no changes to local sales and use tax rates that are effective July 1 2022. Examples of documents available include.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0824 on top of the state tax. With sales tax though its almost never that easy.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

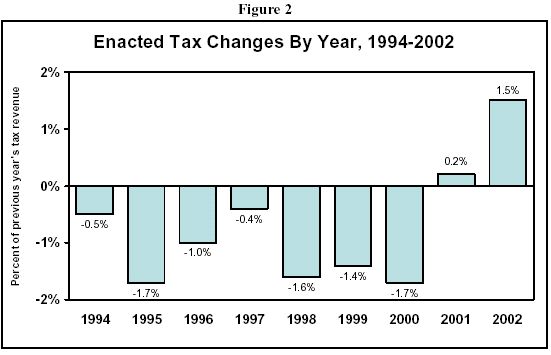

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

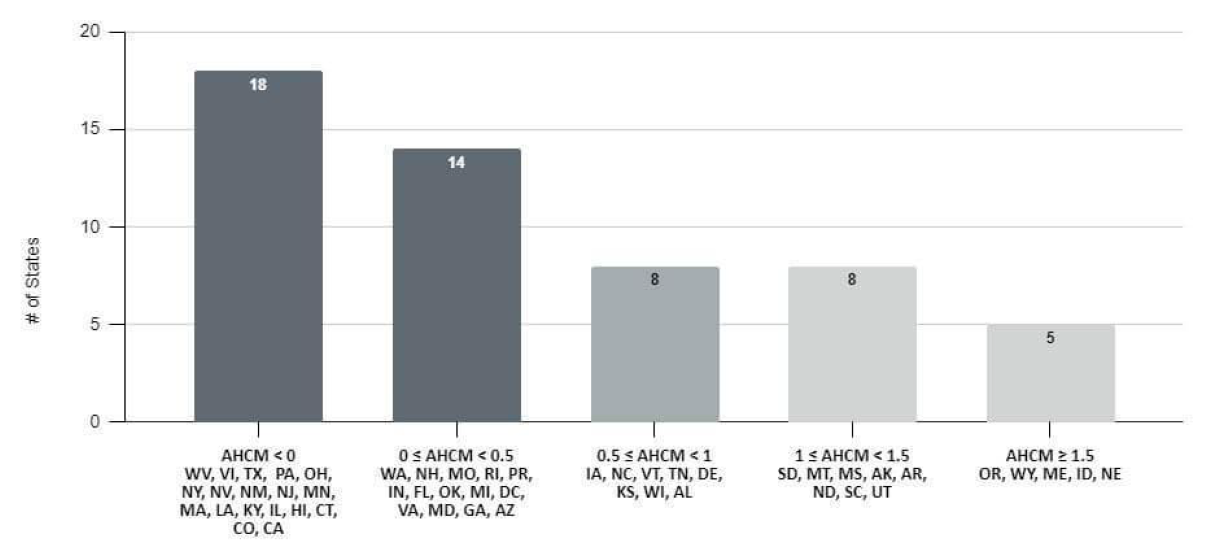

Using The Tax Structure For State Economic Development Urban Institute

Nebraska Sales Tax Handbook 2022

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

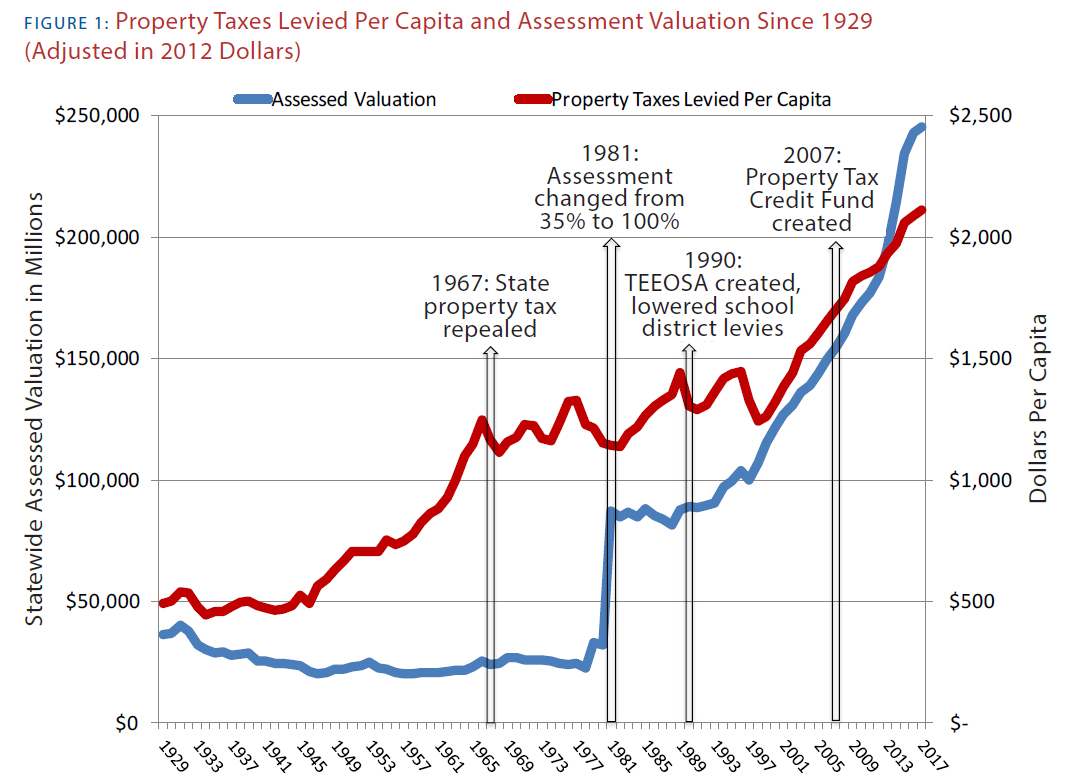

2020 Nebraska Property Tax Issues Agricultural Economics

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

State Income Tax Rates And Brackets 2022 Tax Foundation

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

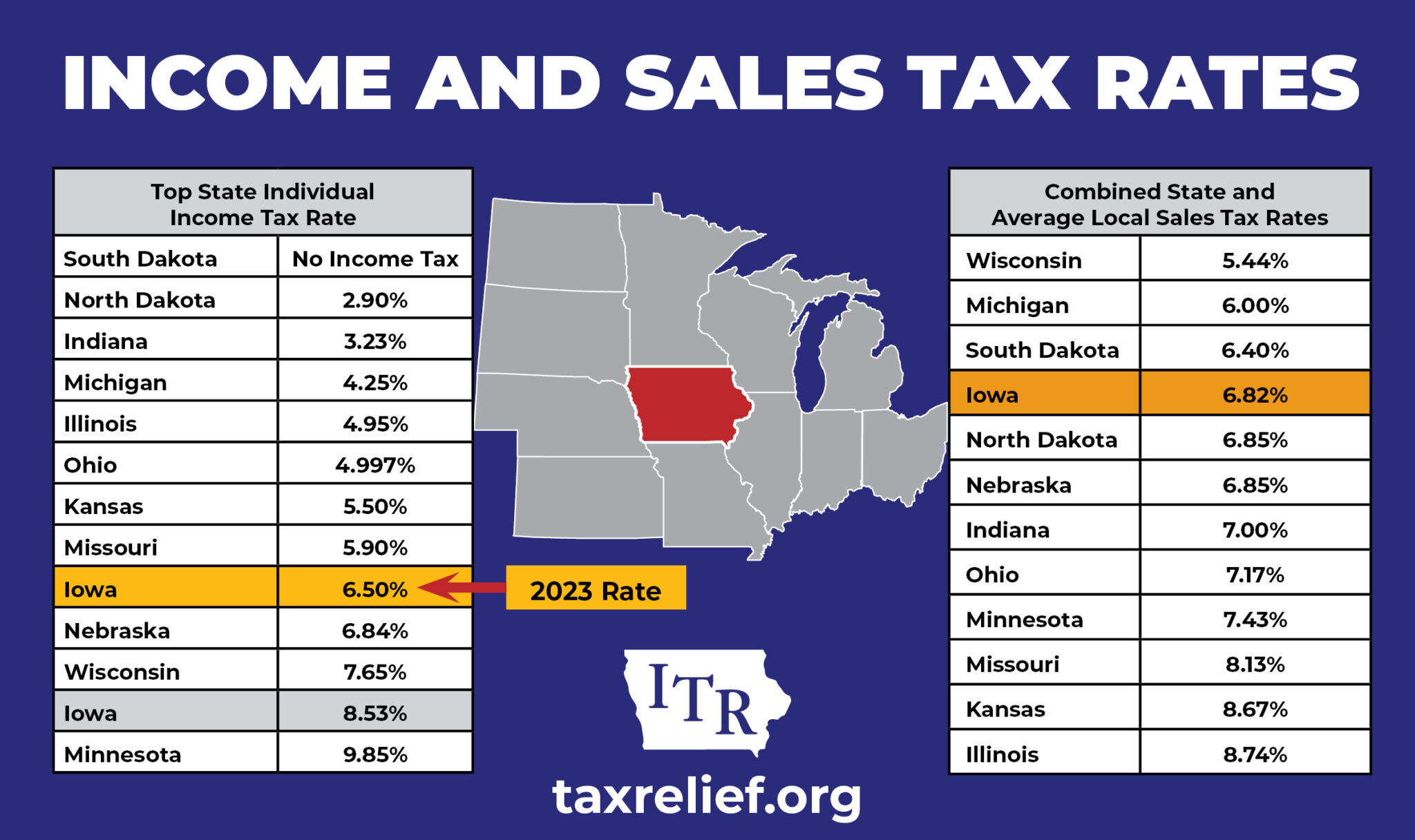

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy